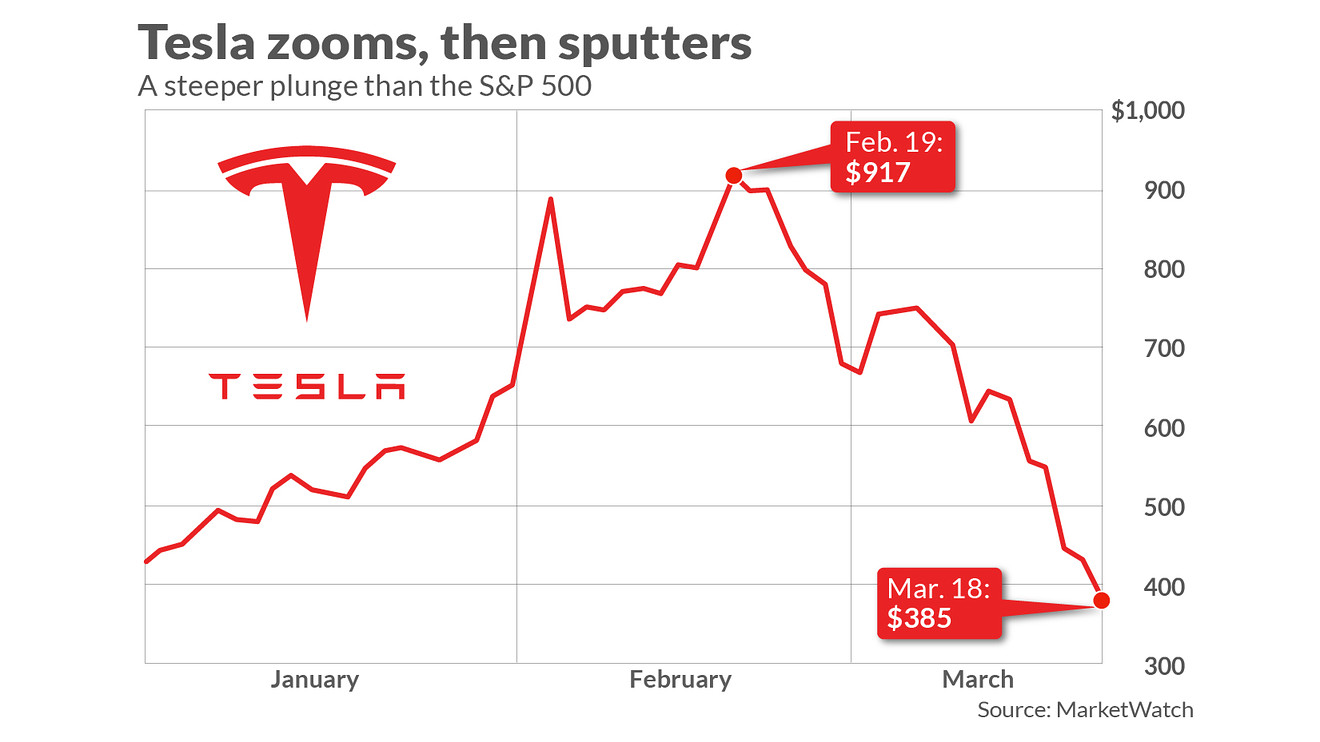

What is Stock Price Prediction?

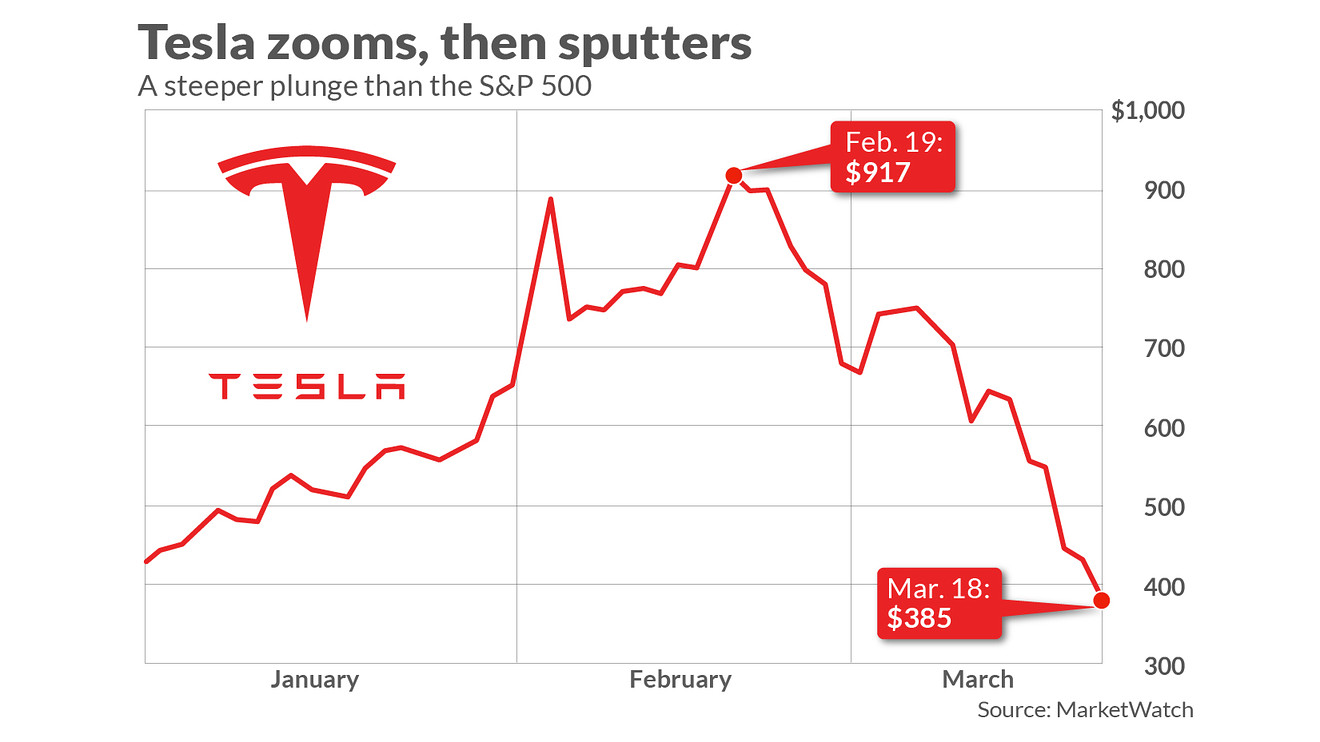

Stock Price Prediction is one of the most popular problems in the series of related problems regarding Time Series data. There, we will use the indicators recorded in the past of a stock and predict its price in the future, so that appropriate investment decisions can be made.

For stock investors who rely on the method of technical analysis (Technical Analysis), they often rely on the adjusted closing price of the stock to make decisions to buy/sell stocks. Therefore, in this project, we will build a model that predicts the adjusted closing price of Tesla company stock based on the indices recorded on stock trading days in the period from 06 /29/2010 to 03/17/2017.

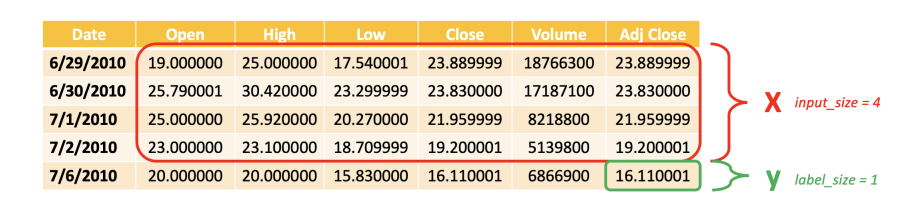

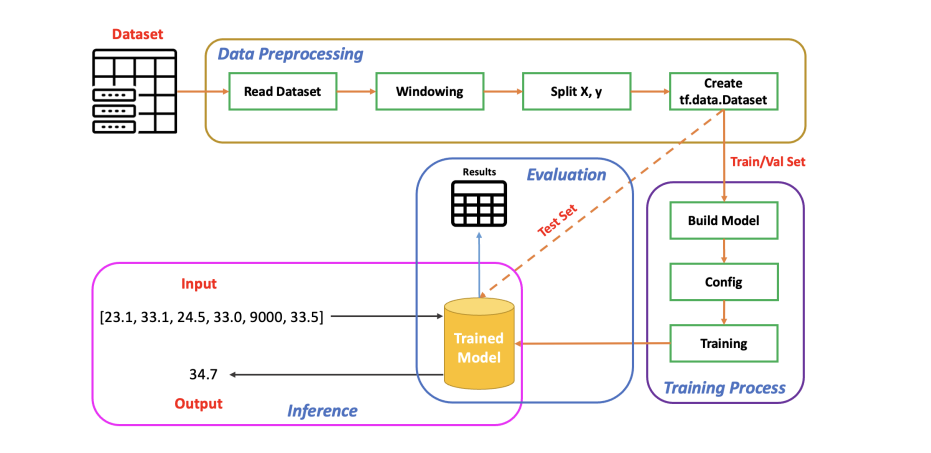

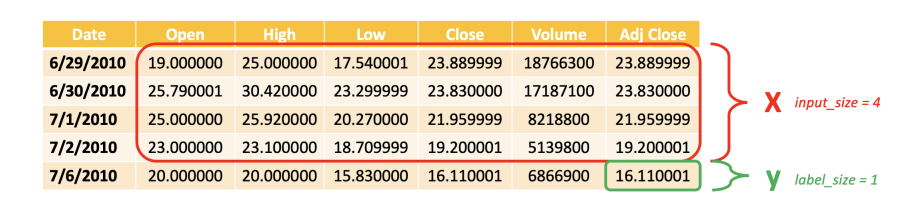

Understand the Input and Output

Input / Output of this project is:

Input: Indexes of stocks in the previous 30 trading days.

Output: Adjusted Closing Price of the current day.

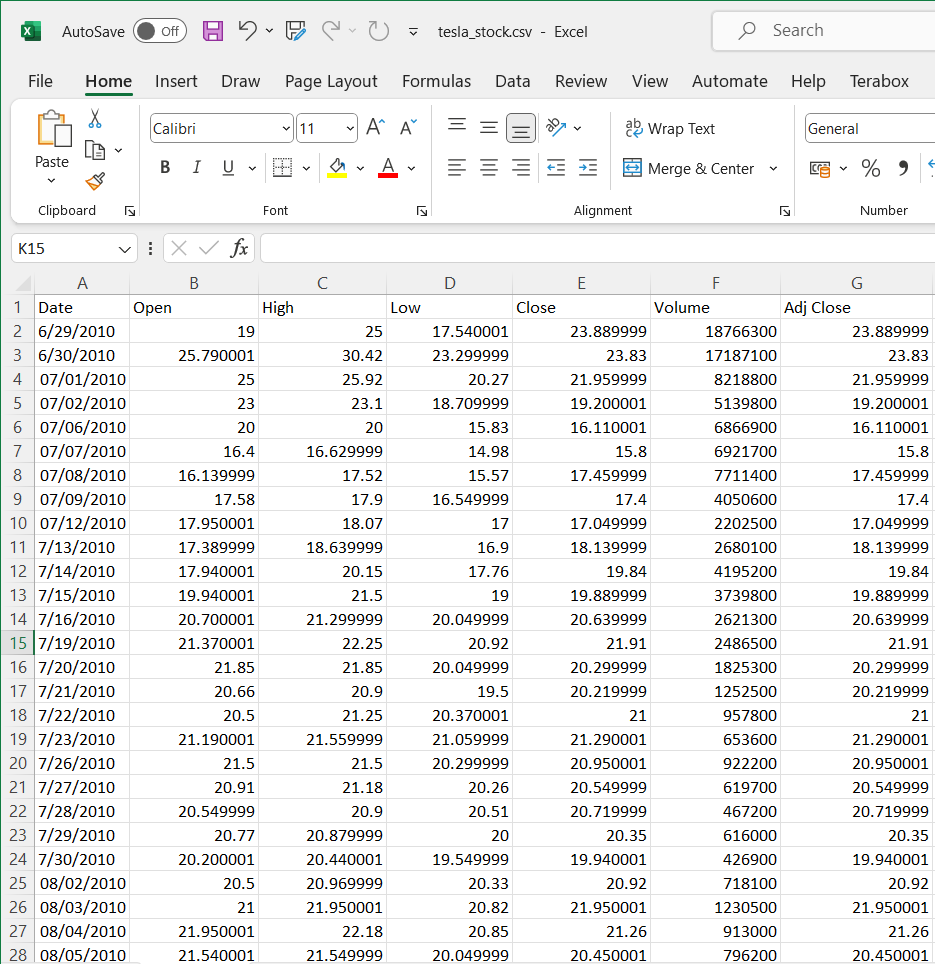

The Data Sources

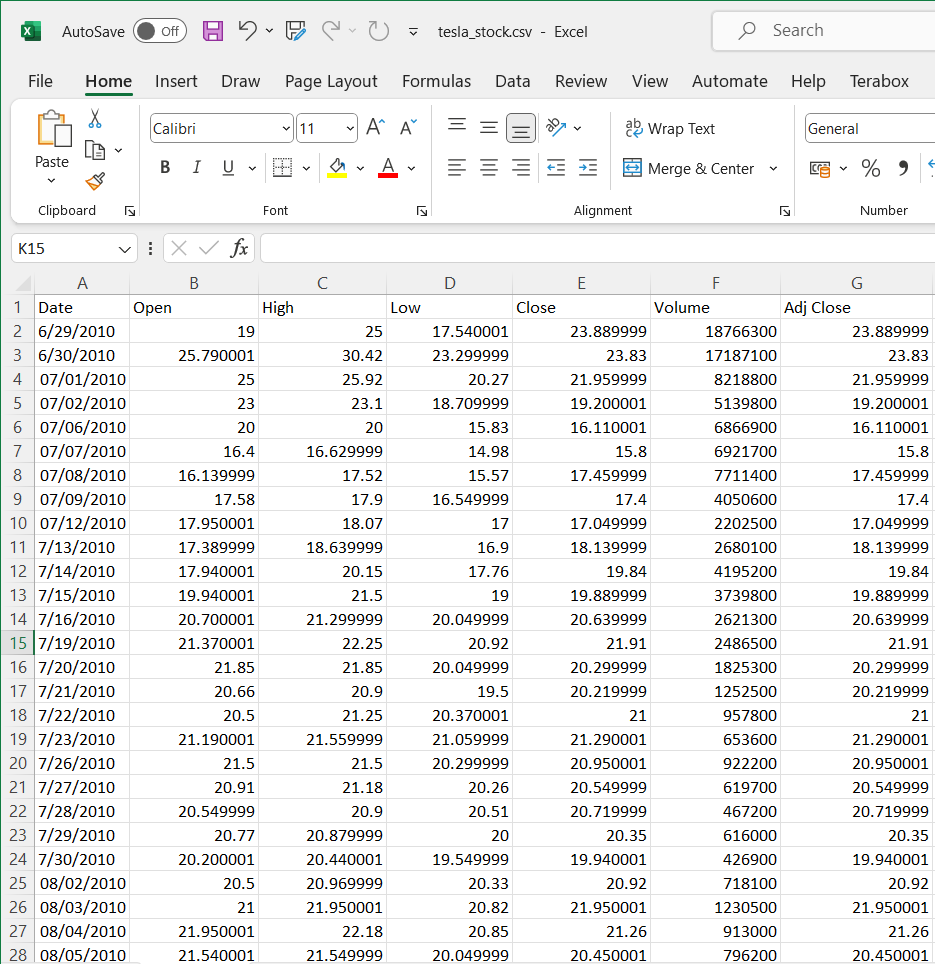

The time - series data

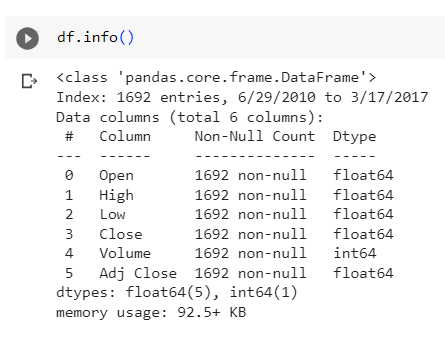

File data source with columns: Date, Open, High, Low, Close, Volume, Adj Close.

Download dataset in my repository: Here

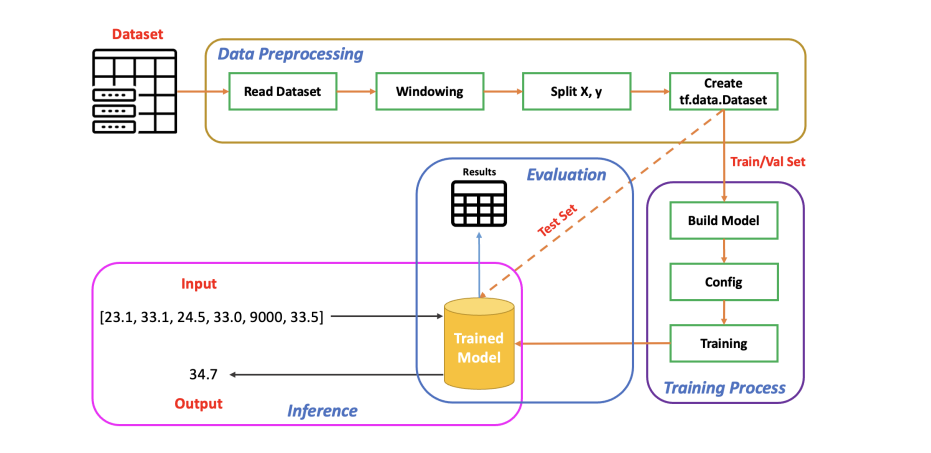

The Pipe Line

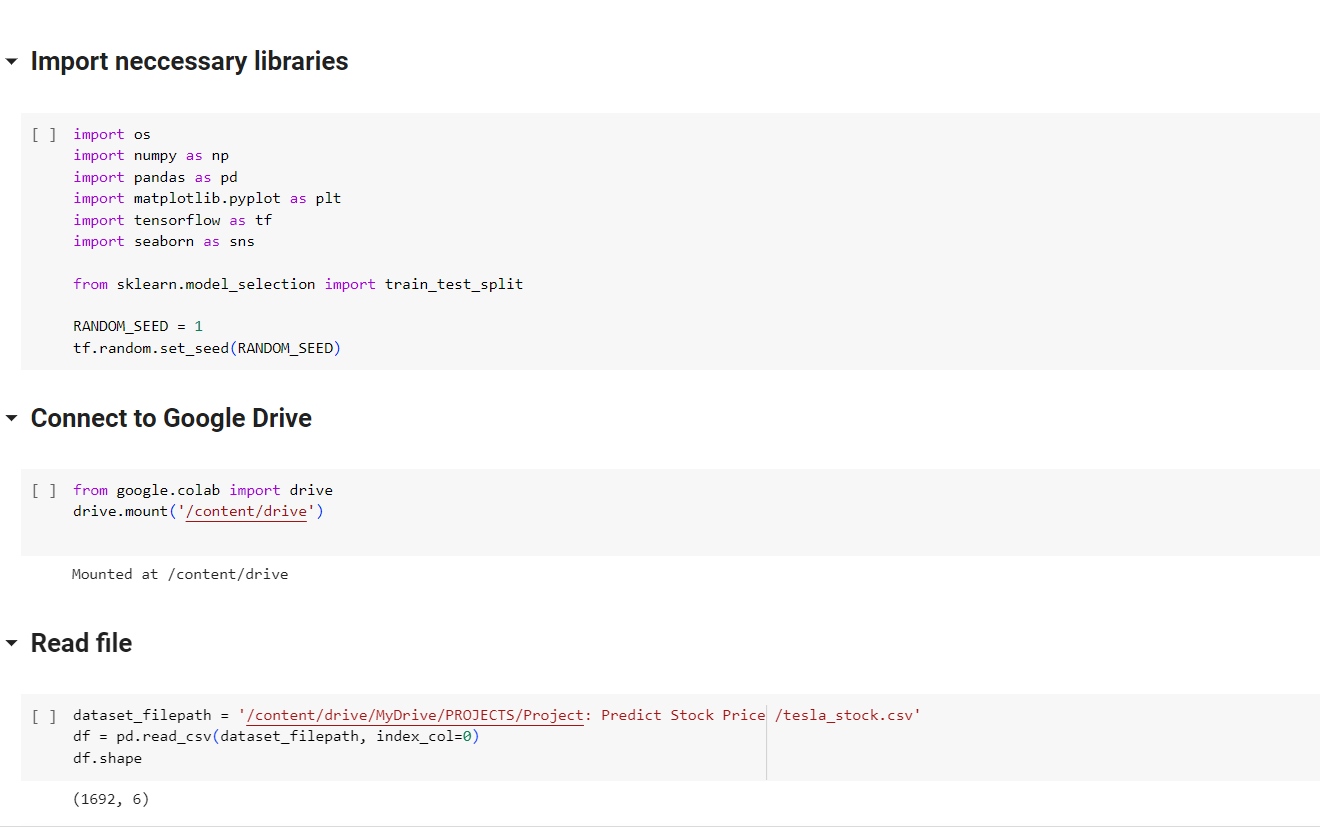

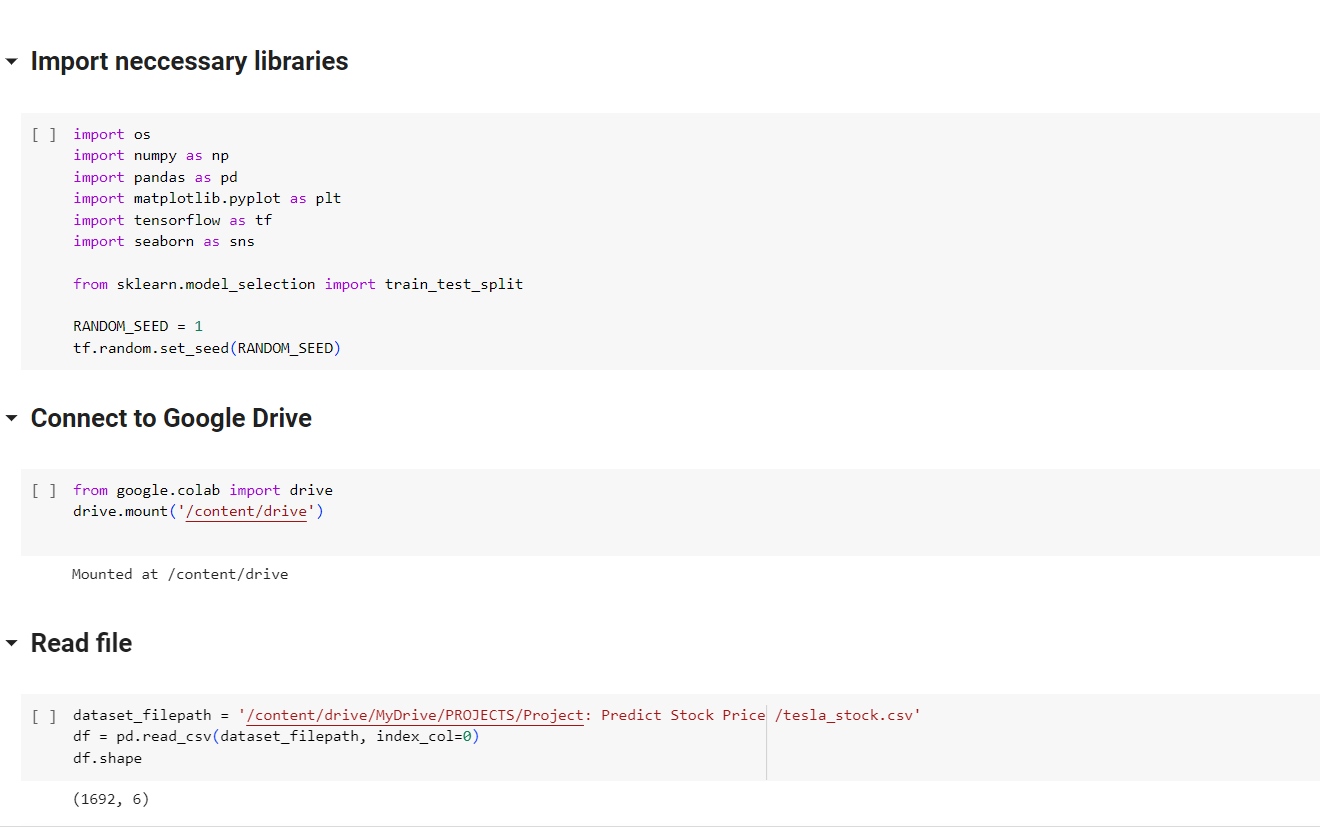

Import necessary libraries and Read File

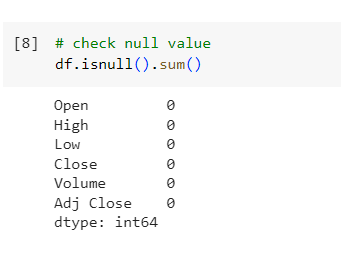

EDA Dataset

df.head()

.PNG)

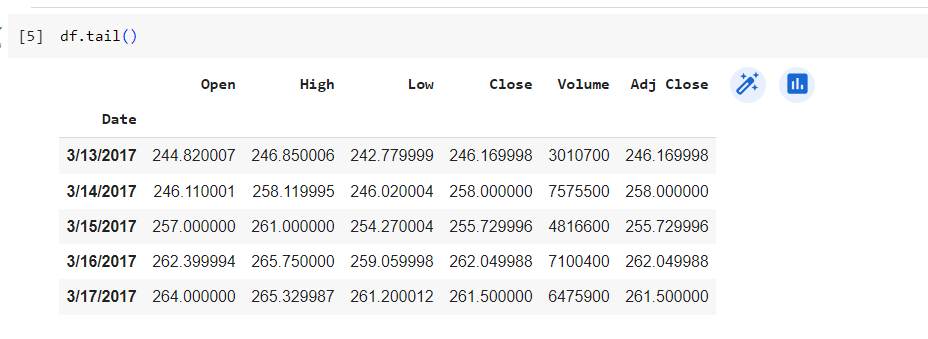

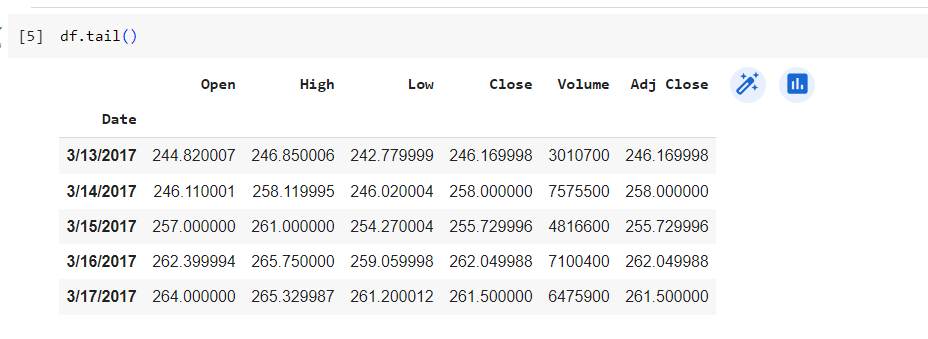

df.tail()

- Date: Transaction date.

- Open: Opening price.

- High: The highest price of the day.

- Low: Lowest price of the day.

- Close: The closing price.

- Volume: Trading volume.

- Adj Close: Corrective closing price.

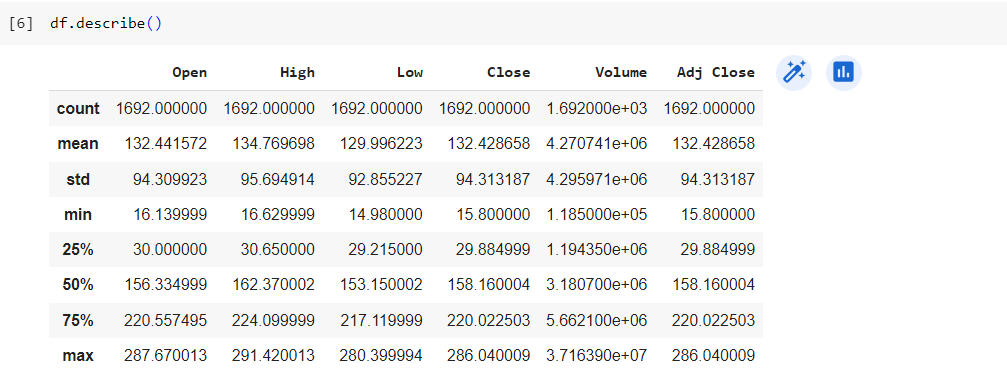

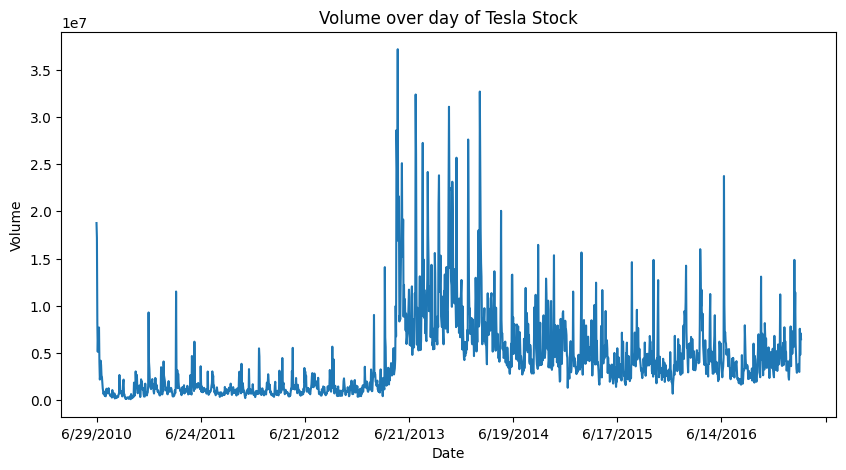

df.describe()

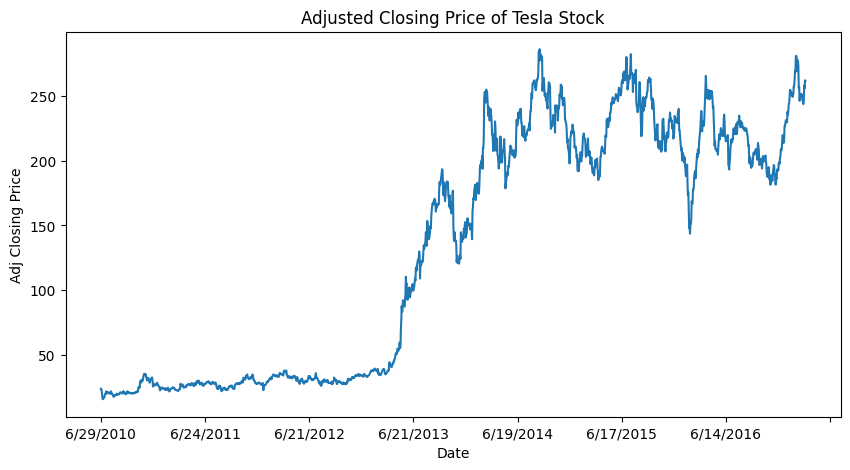

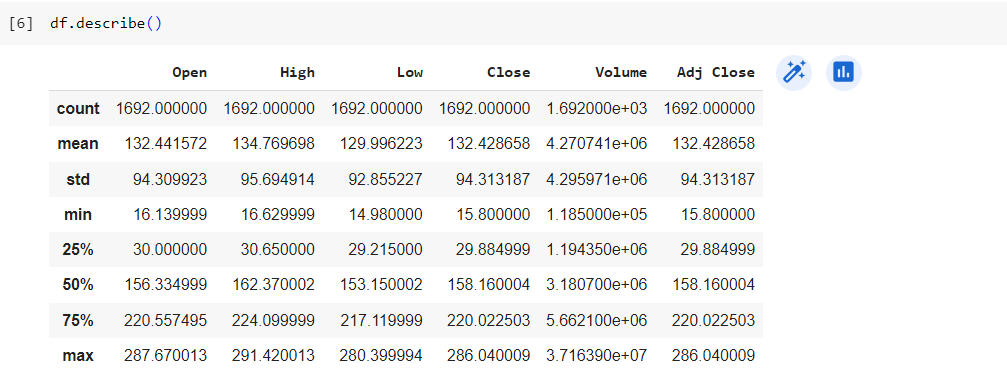

Visualization

# Visualization of Adjusted Closing Price of Tesla Stock

plt.figure(figsize=(10, 5))

df['Adj Close'].plot()

plt.title('Adjusted Closing Price of Tesla Stock')

plt.xlabel('Date')

plt.ylabel('Adj Closing Price')

plt.show()

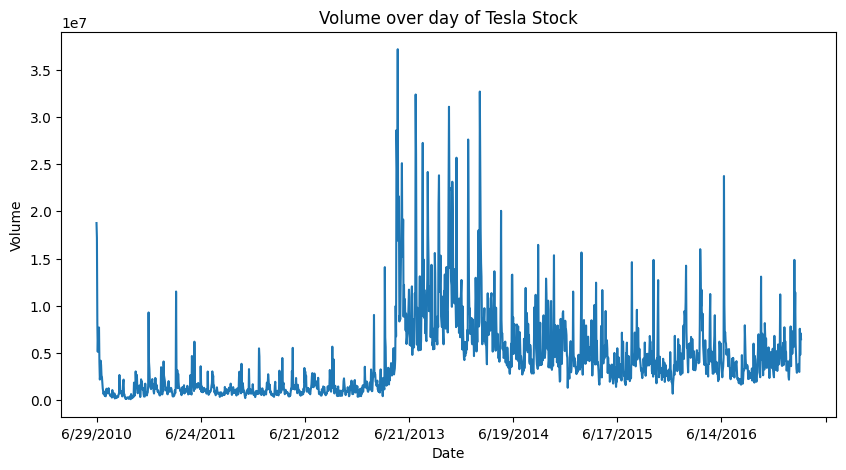

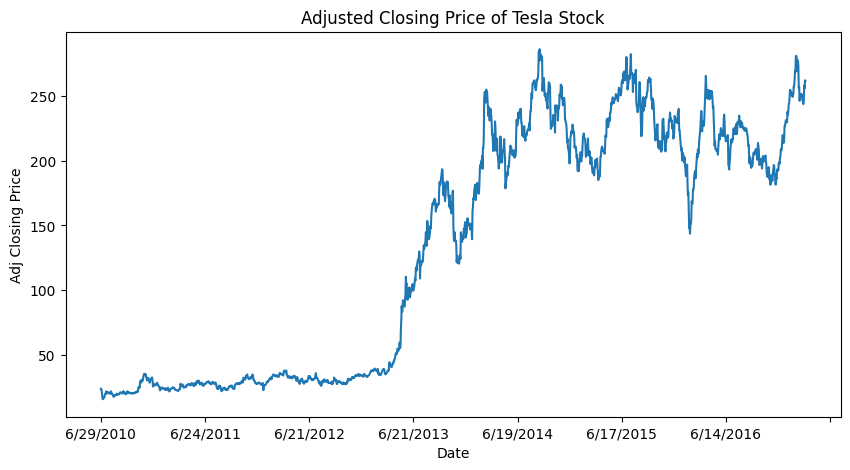

# Visualization of Volume overday of Tesla Stock

plt.figure(figsize=(10, 5))

df['Volume'].plot()

plt.title('Volume over day of Tesla Stock')

plt.xlabel('Date')

plt.ylabel('Volume')

plt.show()

Data Preparation

Use Slicing Windowing Method

# Declare the Windowing function (used to create X, y pairs for time series data)

def slicing_window(df, df_start_idx, df_end_idx, input_size, label_size, offset, label_name):

features = [] # Declare a list to store X

labels = [] # Declare a list to store y

# If df_end_idx equals the last index of the data frame, need to move down by a window size

if df_end_idx == None:

df_end_idx = len(df) - label_size - offset

df_start_idx = df_start_idx + input_size + offset

# Iterate through each data sample

for idx in range(df_start_idx, df_end_idx):

feature_start_idx = idx - input_size - offset

feature_end_idx = feature_start_idx + input_size

label_start_idx = idx - 1

label_end_idx = label_start_idx + label_size

feature = df[feature_start_idx:feature_end_idx] # Get X

label = df[label_name][label_start_idx:label_end_idx] # Get y

features.append(feature)

labels.append(label)

# Convert lists to np.ndarrays

features = np.array(features)

labels = np.array(labels)

return features, labels

Split to Train / Val / Test

dataset_length = len(df) # Number of data samples in the DataFrame

TRAIN_SIZE = 0.7 # Training set ratio

VAL_SIZE = 0.2 # Validation set ratio

# Convert ratios to indices

TRAIN_END_IDX = int(TRAIN_SIZE * dataset_length)

VAL_END_IDX = int(VAL_SIZE * dataset_length) + TRAIN_END_IDX

Make a function call

INPUT_SIZE = 30

LABEL_SIZE = 1

OFFSET = 1

BATCH_SIZE = 64

TARGET_NAME = 'Adj Close'

# Initialize X, y for the training set

X_train, y_train = slicing_window(df,

df_start_idx=0,

df_end_idx=TRAIN_END_IDX,

input_size=INPUT_SIZE,

label_size=LABEL_SIZE,

offset=OFFSET,

label_name=TARGET_NAME)

# Initialize X, y for the validation set

X_val, y_val = slicing_window(df,

df_start_idx=TRAIN_END_IDX,

df_end_idx=VAL_END_IDX,

input_size=INPUT_SIZE,

label_size=LABEL_SIZE,

offset=OFFSET,

label_name=TARGET_NAME)

# Initialize X, y for the test set

X_test, y_test = slicing_window(df,

df_start_idx=VAL_END_IDX,

df_end_idx=None,

input_size=INPUT_SIZE,

label_size=LABEL_SIZE,

offset=OFFSET,

label_name=TARGET_NAME)

Create tf.data.Dataset

for the convenience of training in Tensorflow

# Initilize tf.data.Dataset

train_ds = tf.data.Dataset.from_tensor_slices((X_train, y_train)).batch(BATCH_SIZE)

val_ds = tf.data.Dataset.from_tensor_slices((X_val, y_val)).batch(BATCH_SIZE)

test_ds = tf.data.Dataset.from_tensor_slices((X_test, y_test)).batch(BATCH_SIZE)

# Configuring and Preparing Data

AUTOTUNE = tf.data.AUTOTUNE

train_ds = train_ds.cache().prefetch(buffer_size=AUTOTUNE)

val_ds = val_ds.cache().prefetch(buffer_size=AUTOTUNE)

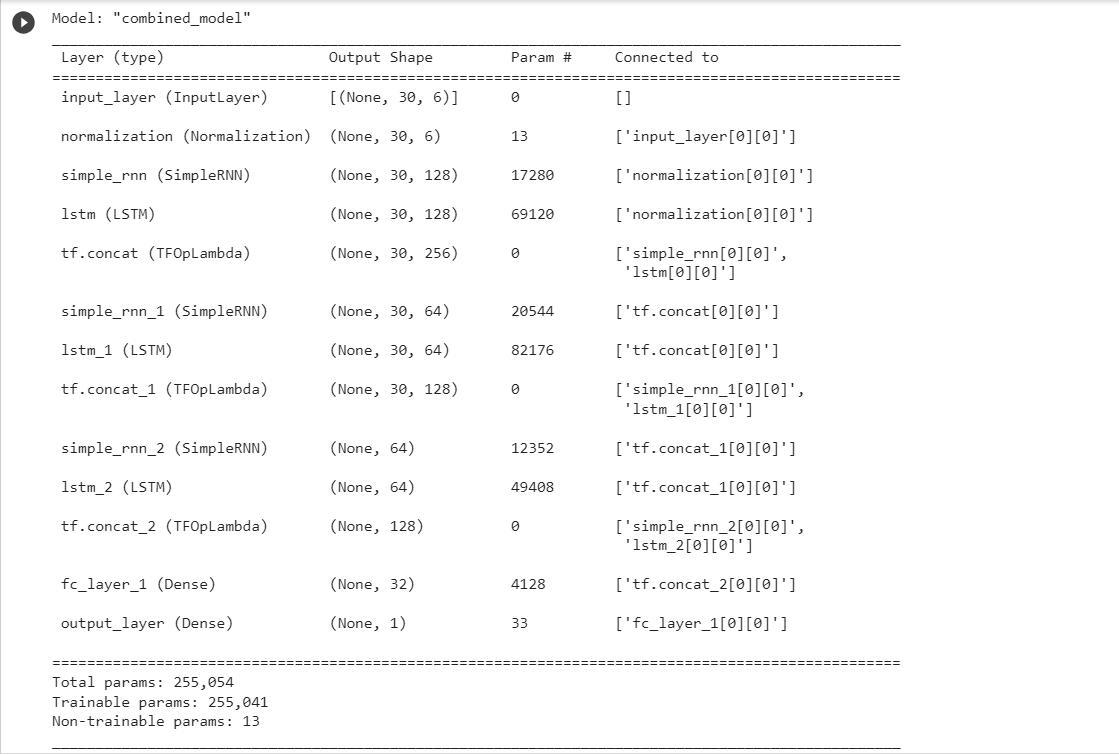

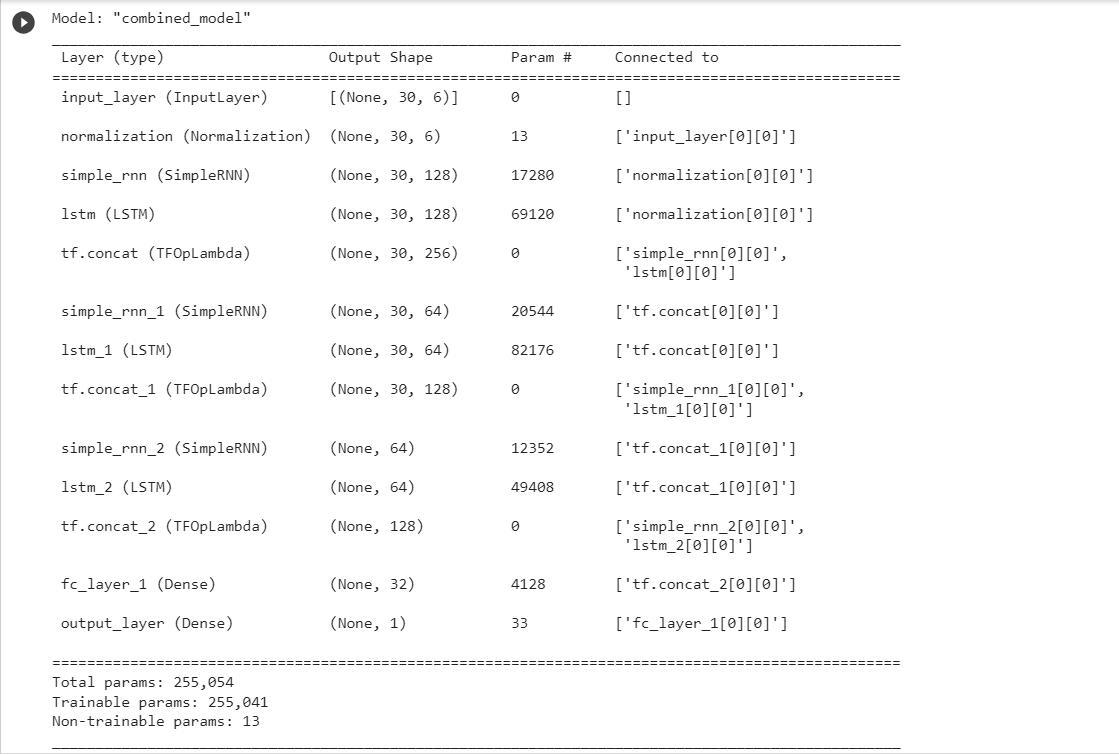

Build Model

# Normalization layer

normalize_layer = tf.keras.layers.Normalization()

normalize_layer.adapt(np.vstack((X_train, X_val, X_test)))

# Build model

def build_model(input_shape, output_size):

input_layer = tf.keras.Input(shape=input_shape, name='input_layer')

x = normalize_layer(input_layer)

for n_unit in [128, 64]:

rnn_x = tf.keras.layers.SimpleRNN(n_unit,

return_sequences=True,

kernel_initializer=tf.initializers.GlorotUniform(seed=RANDOM_SEED)

)(x)

lstm_x = tf.keras.layers.LSTM(n_unit,

return_sequences=True,

kernel_initializer=tf.initializers.GlorotUniform(seed=RANDOM_SEED)

)(x)

x = tf.concat([rnn_x, lstm_x], axis=-1)

rnn_x = tf.keras.layers.SimpleRNN(n_unit,

return_sequences=False,

kernel_initializer=tf.initializers.GlorotUniform(seed=RANDOM_SEED)

)(x)

lstm_x = tf.keras.layers.LSTM(n_unit,

return_sequences=False,

kernel_initializer=tf.initializers.GlorotUniform(seed=RANDOM_SEED)

)(x)

x = tf.concat([rnn_x, lstm_x], axis=-1)

x = tf.keras.layers.Dense(32,

activation='relu',

kernel_initializer=tf.initializers.GlorotUniform(seed=RANDOM_SEED),

name='fc_layer_1'

)(x)

output_layer = tf.keras.layers.Dense(output_size,

kernel_initializer=tf.initializers.GlorotUniform(seed=RANDOM_SEED),

name='output_layer')(x)

model = tf.keras.Model(input_layer, output_layer, name='combined_model')

return model

# Summary of model

INPUT_SHAPE = X_train.shape[-2:]

model = build_model(INPUT_SHAPE,

LABEL_SIZE)

model.summary()

Setting other parameters for the model

# hyperparameter values

EPOCHS = 500

LR = 1e-3

# Some optimization for model

model.compile(

optimizer=tf.keras.optimizers.Adam(learning_rate=LR), # Use optimizer Adam

loss=tf.keras.losses.MeanSquaredError(), # Use loss Mean Squared Error Function

)

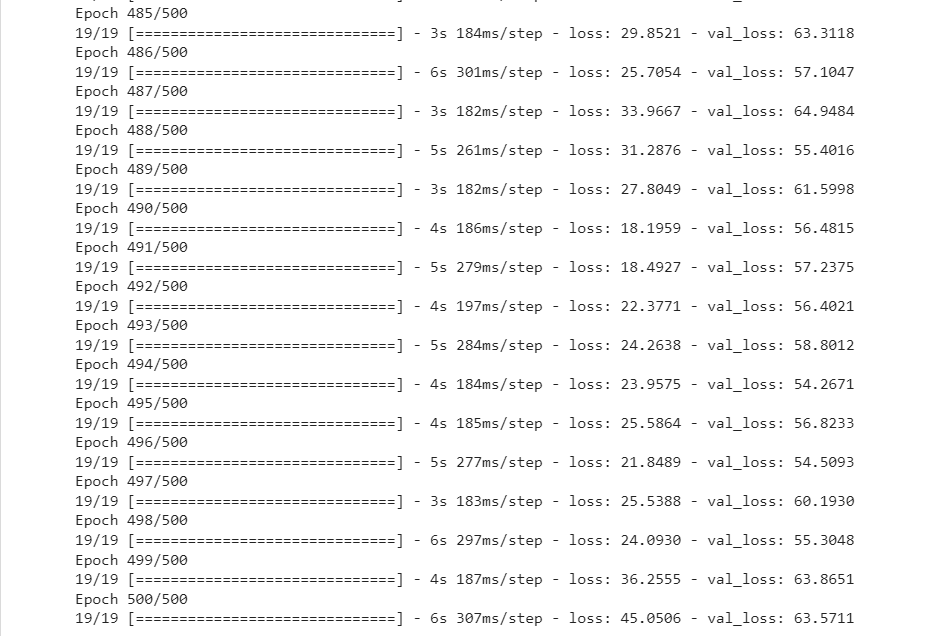

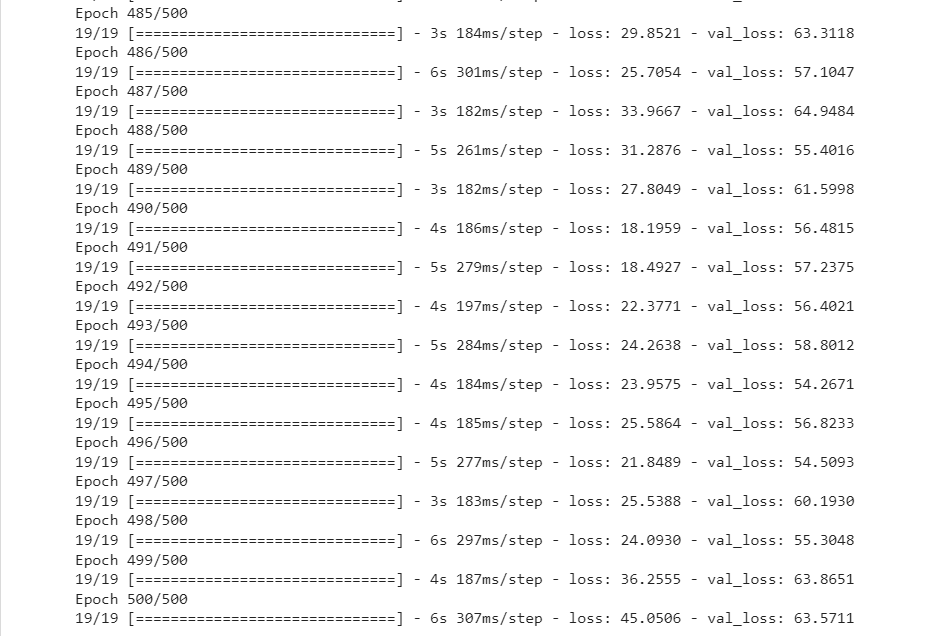

Training Model

history = model.fit(train_ds,

validation_data=val_ds,

epochs=EPOCHS)

Model Evalutation

# Define MAE

def mae(y_true, y_pred):

mae = np.mean(np.abs((y_true - y_pred)))

return mae

# Define MSE

def mse(y_true, y_pred):

mse = np.mean((y_true - y_pred) ** 2)

return mse

# Define RMSE

def rmse(y_true, y_pred):

rmse = np.sqrt(np.mean((y_true-y_pred)**2))

return rmse

# Define MAPE

def mape(y_true, y_pred):

mape = np.mean(np.abs((y_true-y_pred) / y_true)) * 100

return mape

# Print result

y_test_pred = model.predict(X_test, verbose=0)

print(f'RMSE: {rmse(y_test, y_test_pred)}')

print(f'MAPE: {mape(y_test, y_test_pred)}')

print(f'MSE: {mse(y_test, y_test_pred)}')

print(f'MAE: {mae(y_test, y_test_pred)}')

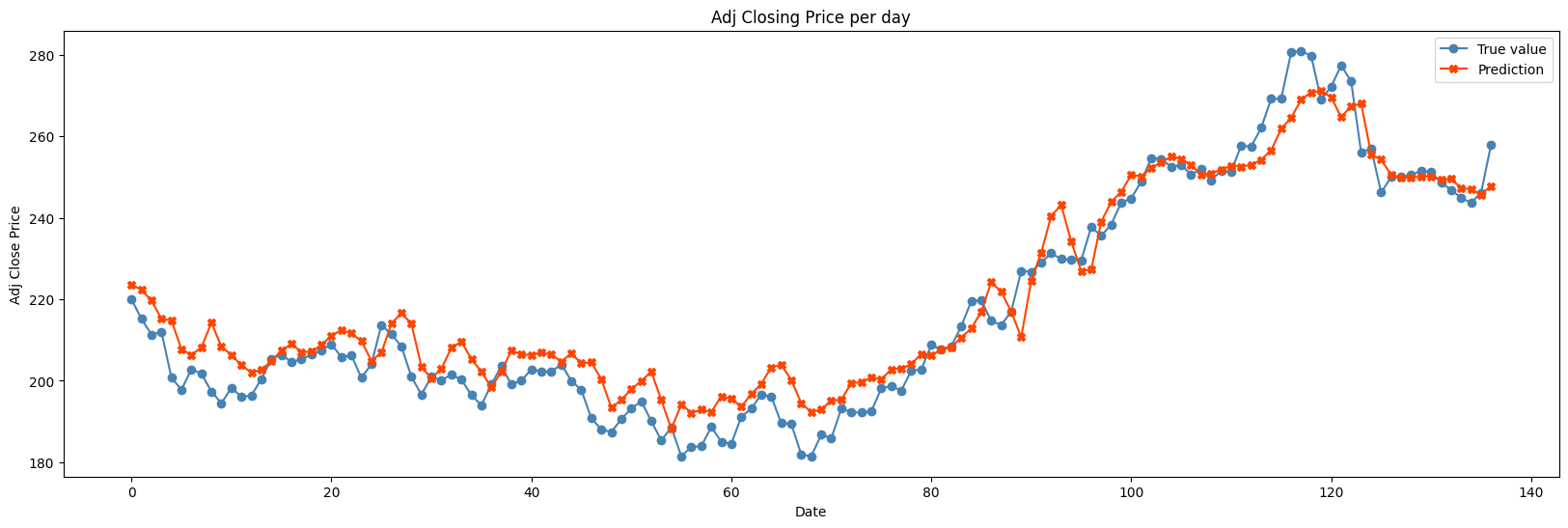

The result is:

- RMSE: 7.08275569019287

- MAPE: 2.698402709155248

- MSE: 50.16542816695947

- MAE: 5.680429943373632

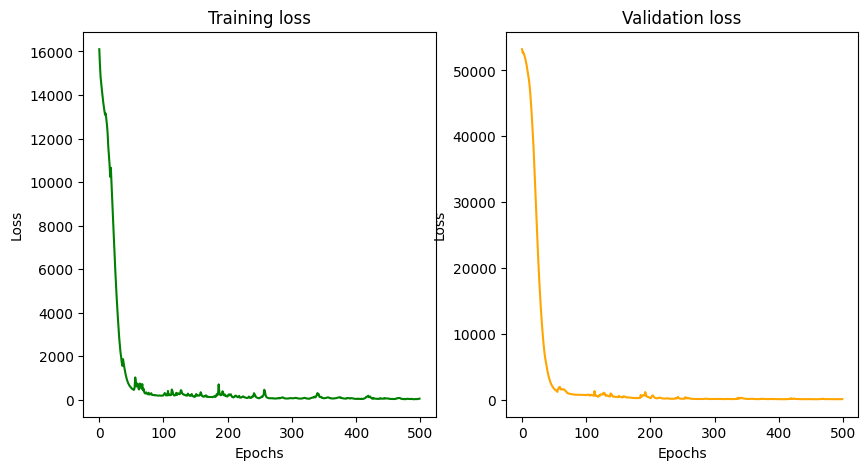

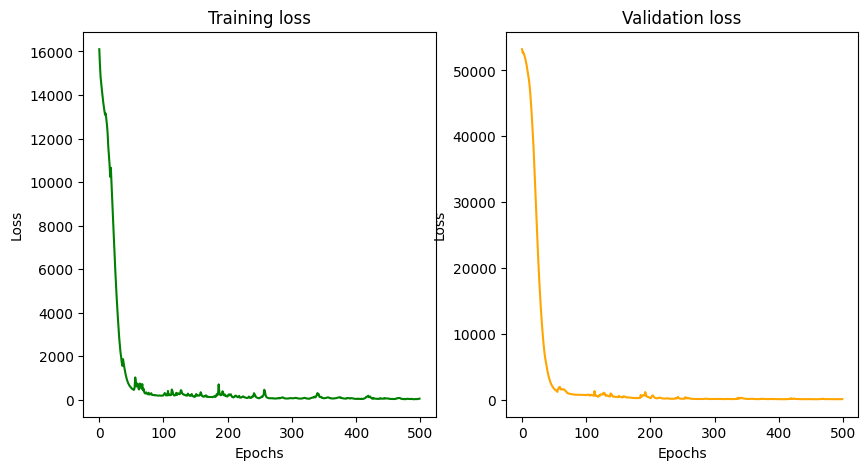

Visualization Result

Visualize loss / accuracy results during training

train_loss = history.history['loss'] # Read training loss information

val_loss = history.history['val_loss'] # Read validation loss information

plt.figure(figsize=(10, 5)) # Set the figure size

plt.subplot(1, 2, 1) # Initialize the plot for training loss

plt.xlabel('Epochs') # Display the x-axis label as 'Epochs'

plt.ylabel('Loss') # Display the y-axis label as 'Loss'

plt.title('Training loss') # Display the title of the current plot as 'Training Loss'

plt.plot(train_loss, color='green') # Plot the training loss values over epochs (plotting in green)

plt.subplot(1, 2, 2) # Initialize the plot for validation loss

plt.xlabel('Epochs') # Display the x-axis label as 'Epochs'

plt.ylabel('Loss') # Display the y-axis label as 'Loss'

plt.title('Validation loss') # Display the title of the current plot as 'Validation loss'

plt.plot(val_loss, color='orange') # Plot the validation loss values over epochs (plotting in orange)

plt.show() # Display both small plots

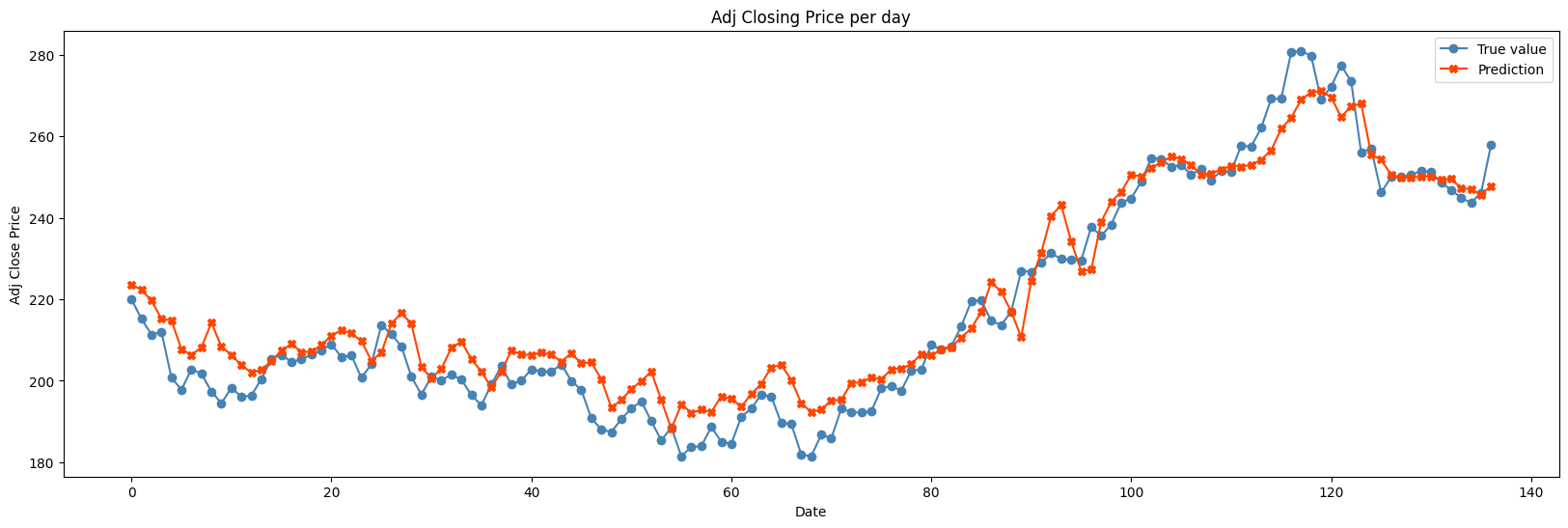

Visualize the predicted value compared to the actual value on the test set

def plot_difference(y, pred):

plt.figure(figsize=(20, 6))

times = range(len(y))

y_to_plot = y.flatten()

pred_to_plot = pred.flatten()

plt.plot(times, y_to_plot, color='steelblue', marker='o', label='True value')

plt.plot(times, pred_to_plot, color='orangered', marker='X', label='Prediction')

plt.title('Adj Closing Price per day')

plt.xlabel('Date')

plt.ylabel('Adj Close Price')

plt.legend()

plt.show()

plot_difference(y_test[:300], model.predict(X_test[:300], verbose=0))

Based on low-value MAE, MSE, RMSE and MAPE metrics, as well as training loss visualization, validation loss, and predicted versus true value visualization on the test set, it is possible concluded that the model performed well in predicting Tesla's stock price!

View my full project: Here

.PNG)